SYDNEY: Asian share markets mostly rose on Wednesday but oil and the dollar slipped as rising COVID-19 cases in China raised fears of fresh lockdowns that could slow the reopening of the world’s second-largest economy.

European equities looked set to follow Asia higher, with the pan-region Euro Stoxx 50 futures up 0.33%, Germany’s DAX futures up 0.27% and FTSE futures up 0.16%. U.S. stock futures, the S&P 500 e-minis, slipped 0.07%.

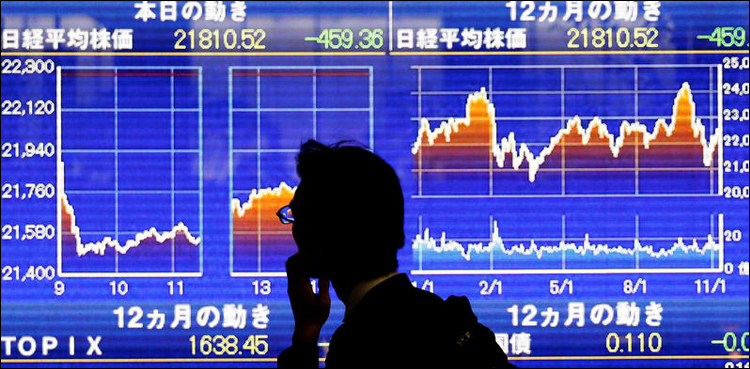

MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.4%, buoyed by gains in US stocks overnight. The index is up 12% so far this month.

Australian shares were up 0.63%, led by mining and resources giants. Japan’s stock market was closed for a national holiday.

New Zealand’s central bank raised interest rates by 75 basis points – its largest ever move – on Wednesday to a near 14-year high of 4.25% and flagged more hikes are on the way as it struggles to contain stubbornly high inflation.

Hong Kong’s Hang Seng Index was up 0.46% in early trade while China’s CSI300 Index was down 0.2%.

China on Wednesday reported 29,157 new COVID infections for Nov. 22, compared with 28,127 new cases a day earlier. Case numbers in Beijing and Shanghai are steadily rising, and remain high in several major manufacturing and export hubs, prompting authorities to close some facilities.

“The biggest story for investors in Asia is still the China reopening,” said Suresh Tantia, Credit Suisse’s senior investment strategist in Singapore.

“We had seen China markets rally up to 20% but those expectations are being dialled back, we think a reopening will be a slower process and will not be done in a hurry. That means a lot of investors are trimming their exposure, cutting their losses or booking any profits they might have made on China.”

Read more: Oil prices climb on big drop in US crude stocks, Russia supply uncertainty

Meanwhile, the release of US Federal Reserve minutes from its November policy meeting later on Wednesday is being keenly awaited by investors as they look for any sign of discussions about moderating the pace of interest rate hikes.

The November consumer price index will be published on Dec. 13, the day before the central bank delivers its final interest rate decision for 2022.

“The Fed is going to be very data driven and they are will need to see more than one softer inflation result because one weaker month in October is not a trend,” said Clara Cheong, JPMorgan Asset Management investment strategist.

“If November shows inflation cooling, we still think the Fed will raise by 50 basis points rather than less or showing any signs they are starting a pivot.”

In Asian trading, the yield on benchmark 10-year Treasury notes rose to 3.7578% compared with its U.S. close of 3.758% on Tuesday.

from Business News updates - Latest news stories on Economy from Pakistan https://ift.tt/EtsYp1h

0 Comments